If you received more than $600 and want to transfer all of it to an external bank account, this is what you do.

By now, millions of Californians either received their Middle Class Tax Refund through direct deposit or in the mail as a pre-paid debit card from “My Banking Direct – A service of New York Community Bank.”

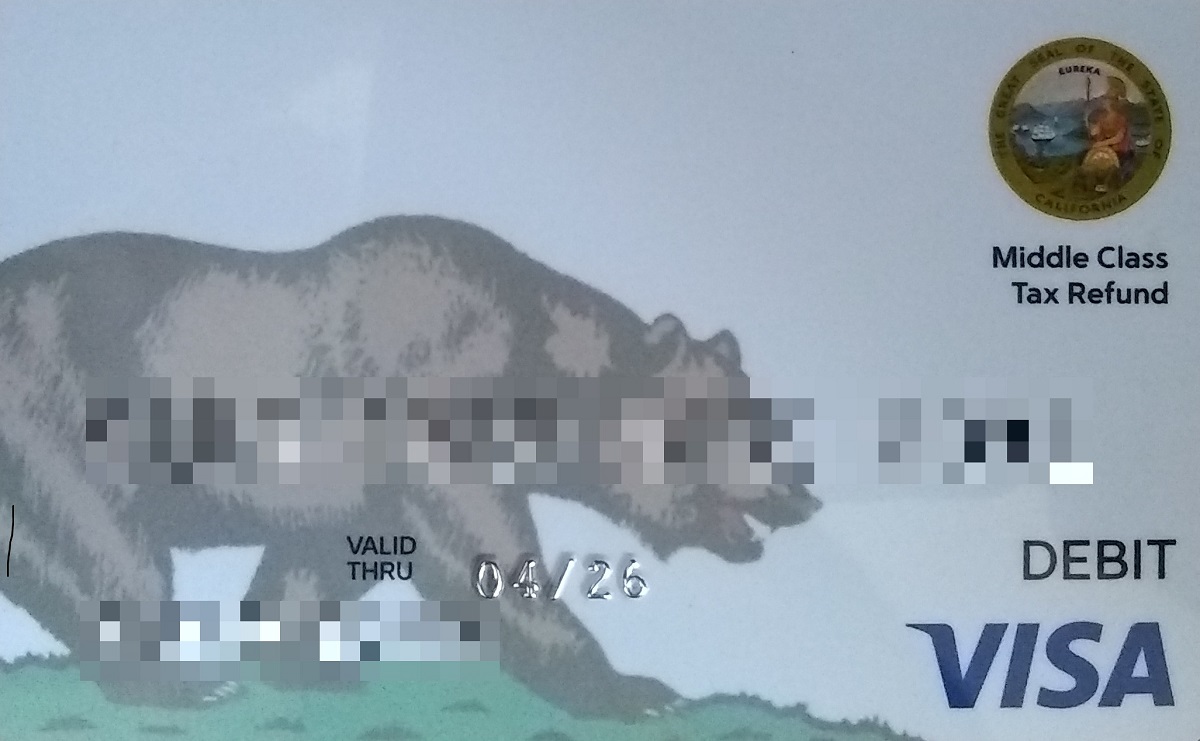

The card looks something like this, below.

If you found this blog, you probably found out that you can’t transfer more than $600 at a time to an external bank account in any one transaction.

According to My Banking Direct’s FAQ,

“ACH Transfer to Domestic Bank Limits Apply: $600 per transaction. Please see your Cardholder Agreement and Fee Schedule online at mctrpayment.com for more information.

With some Californians receiving up to $1,050, how do you send the rest of the money to your bank?

If this answer wasn’t already obvious, you must set up more than one transfer to send all your money.

With the max being $1,050 that means two transfers is enough.

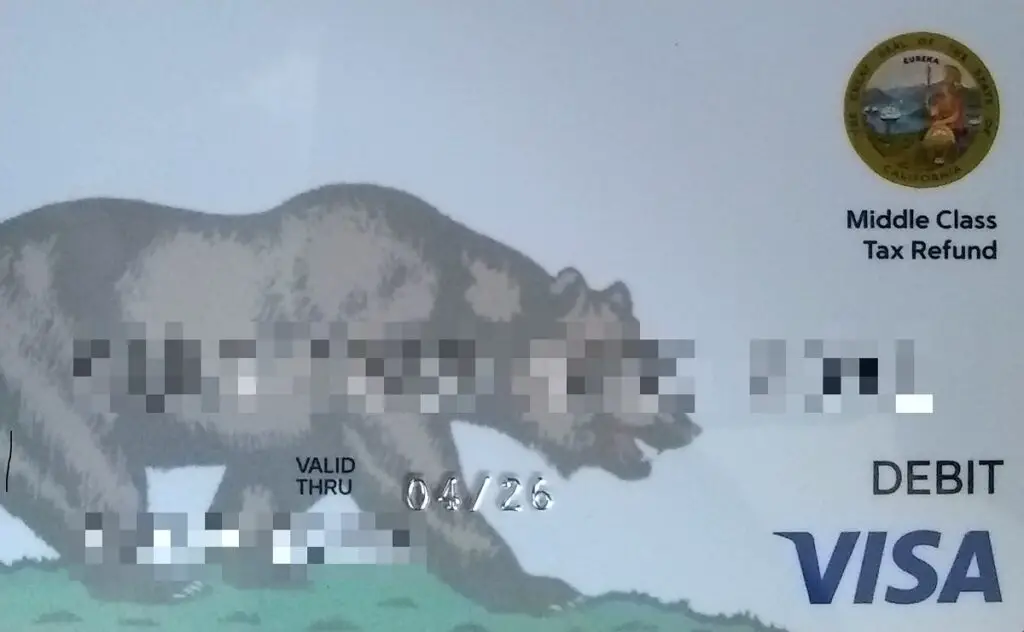

Here’s a screenshot of the Transfer money screen from My Banking Direct.

I personally only got back $350, so one transfer was OK, but my parents received $700, and I informed them, once they were able to log in, that they had to set up two transfers, one for $600, and another for $100.

Once I hear back from them that their local credit union’s received both amounts, you can basically cut up your card and toss it as it’s non-reloadable and no longer of any use.

I hope that cleared it up for any confused Californians that read this.